THE RIGHT LOAN, STRAIGHT FROM THE SOURCE.

In short, we work for YOU; not the banks. We’re committed to your best interests.

Enquire Now

For an obligation free chat with one of our expert brokers.

"*" indicates required fields

Get a personalised quote in 3 minutes

Applying does not impact your credit score.

Check Eligibility🔒 Confidential, Safe and Secure

By continuing you agree to our privacy policy

No matter why you’re here, you’re at the right place at Buddii.

There are far more important things to worry about with your work and business, so leave the heavy lifting to us and let us find the best novated lease in Brisbane for you.

Are you currently working a job with employee benefits? Does your employer offer salary packaging? Maybe you just want a tax-effective way of sorting out a new car purchase? If you answered yes to any of these questions, then a novated leasing in Brisbane might be the perfect solution.

Please note: This is an estimate provided for illustrative purposes only, and is based on the accuracy of information provided. It does not constitute a quote. Additional fees and charges may apply dependent on your individual circumstances. Fees such as early repayment costs and establishment fees are not accounted for in the examples of weekly repayments. Interest rates may be subject to change throughout the term of the loan.

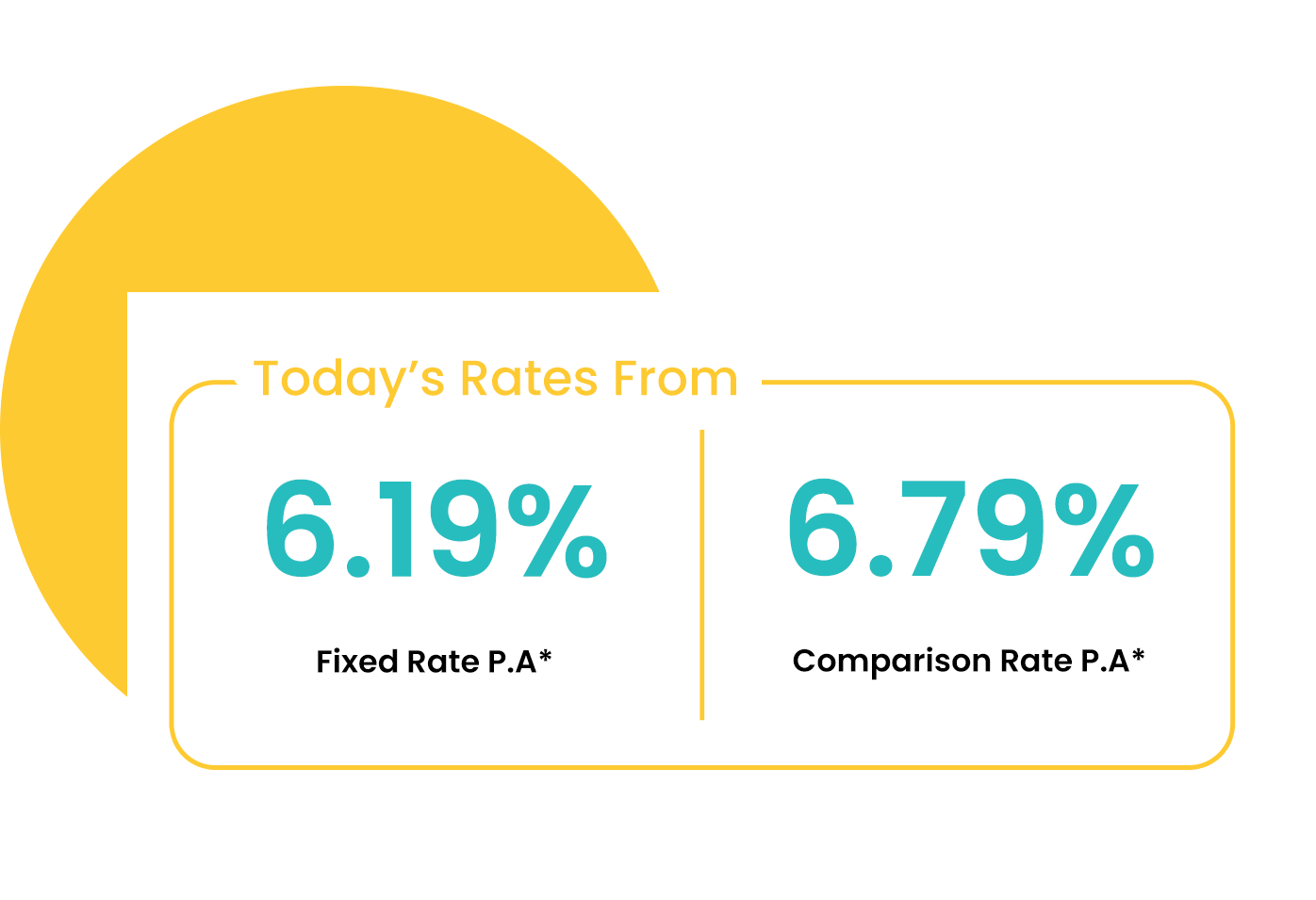

Flexible novated lease terms ranging in duration

Access to some of the lowest novated lease interest rates available

Fixed repayments

What Exactly is a Novated Lease?

A novated lease is a new car loans or a novated lease for a motorbike, except that instead of being between you and a financial institution or a lender, the agreement takes place between you, your employer and a financial company. Your employer agrees to take on responsibility for the lease, but the payments are made from your pre-tax pay. So what this means is that you can package the costs of a brand new car while saving GST and paying less tax! The transfer and rights for the novation are agreed in a deed which exists between your lender, your employer and you. When you have paid off the loan or leave the company, the lease obligation transfers back to you. It’s a Payroll Deduction that Covers All Your Running Costs.

- Fuel

- Registration

- CTP

- Servicing and maintenance

- Insurance

- Tyres

- 24 hour roadside assistance

What Kind of Car Can I Buy With a Novated Lease?

You can buy any car of any make and any model when you purchase using a novated lease in Australia.

- New car (potential for access to fleet discounts)

- Second-hand car (though there will be some restrictions as far as age and value are concerned)

- Your current vehicle (under a sale and lease agreement)

At Buddii, we are proud to also be able to help you save on the overall purchase price and find your new car faster through our exclusive partnership with trusted Australian automotive groups.

Residual Value for Novated Leases

Something you need to consider when it comes to taking out a novated lease is the residual value of your car, or the amount of money left over on your car at the end of your financial period.

This amount attracts GST and is worked out starting from the beginning of your lease. Once your loan term has expired, you can either pay the balance of the novated lease or renew your finance.

The loan experts at Buddii will work closely with you to determine your needs, lifestyle and financial situation to match you with a novated lease with the right terms for you.

How Do I Know if I Can Get a Novated Lease?

Not everyone can get a novated lease – your employer needs to offer salary packaging as part of their payment options before you can qualify for a novated lease.

Novated leases are classified as a commercial finance product, and as such, they can only be used for a vehicle that is primarily used for business purposes.

A novated lease can offer exceptional benefits to consumers and employers alike, and at Buddii, we offer novated leases with full disclosure and transparency so you always know where you stand. Conact our team to find out more.

faqs

Yes indeed. In many cases (provided you’re not on a lease), you can exit your loan early. The exit fees are usually quite reasonable, but you would need to get clarification from your Buddii broker to find out exactly how much the fees are for each lender.

That depends! But usually, once your loan is approved and signed, we can settle and pay into the right accounts within 24 hours.

I’ve only got a learner’s licence. Can I still get finance?

Yes, you can. We’ll even go a step further and check out the seller to make sure that any amount left owing on the asset is paid out at settlement.

We are financial brokers and specialists in linking you with the right loan product for your needs. We can provide you with a great rate on finance for cars, boats, trucks, equipment, machinery and a lot more. Get in touch to find out more about what we can finance.

our lenders

We work with a diverse range of top-tier lenders to make sure that you secure the competitive loan interest rates and finance product for your personal needs and budget. We know that getting a loan is a big deal, and you want to ensure that you have solid financial backing from the best Australian lenders. At Buddii, we partner with leading banks and financial institutions to offer the kind of wholesale rates that simply aren’t available anywhere else. This gives you more options for finding the ideal finance.

Contact our novated leasing Specialists Today

Start reaping the rewards of car finance leasing with Buddii. Our experienced loan brokers will work hard for you to uncover the perfect finance solution for your circumstances. We believe in matching our clients with the right lender, affordable rates and terms that work for you, and we won’t stop until we find you the perfect product.

We’re dedicated to your happiness, so pick up the phone and give us a call on [phone number] or get started today with our online contact form.

Call us on 1300 283 344 today to find out how we can help you. You can also send us a message for any questions or enquiries about getting a loan rate the suits your financial situation in Australia.

Enquire Now With Buddii

For an obligation free chat with one of our expert brokers.

"*" indicates required fields

location

KEEP IN THE FINANCIAL LOOP

sign up to our e-news feed