THE RIGHT LOAN, STRAIGHT FROM THE SOURCE.

In short, we work for YOU; not the banks. We’re committed to your best interests.

Enquire Now

For an obligation free chat with one of our expert brokers.

"*" indicates required fields

Get a personalised quote in 3 minutes

Applying does not impact your credit score.

Check Eligibility🔒 Confidential, Safe and Secure

By continuing you agree to our privacy policy

Our brokers can assist in tailoring a loan to suit your business needs.

Growing a business requires capital. To grow profitably, you need to invest in the right machinery and equipment that will increase your productivity and drive efficiency and performance. This is where having the right equipment loan comes in.

An equipment loan allows you to take advantage of business opportunities by having the appropriate equipment when and where you need it. Don’t risk missing out on a valuable prospect for the sake of some equipment – secure the right equipment loans in Brisbane today with the help of Buddii’s loan brokers.

As one of the leading equipment financing companies in Brisbane, we can help you find and secure the right equipment loan to drive your business forward. Whether you need standard equipment loans or equipment financing with special terms and features, our loan specialists will help you find finance solutions that work in your favour.

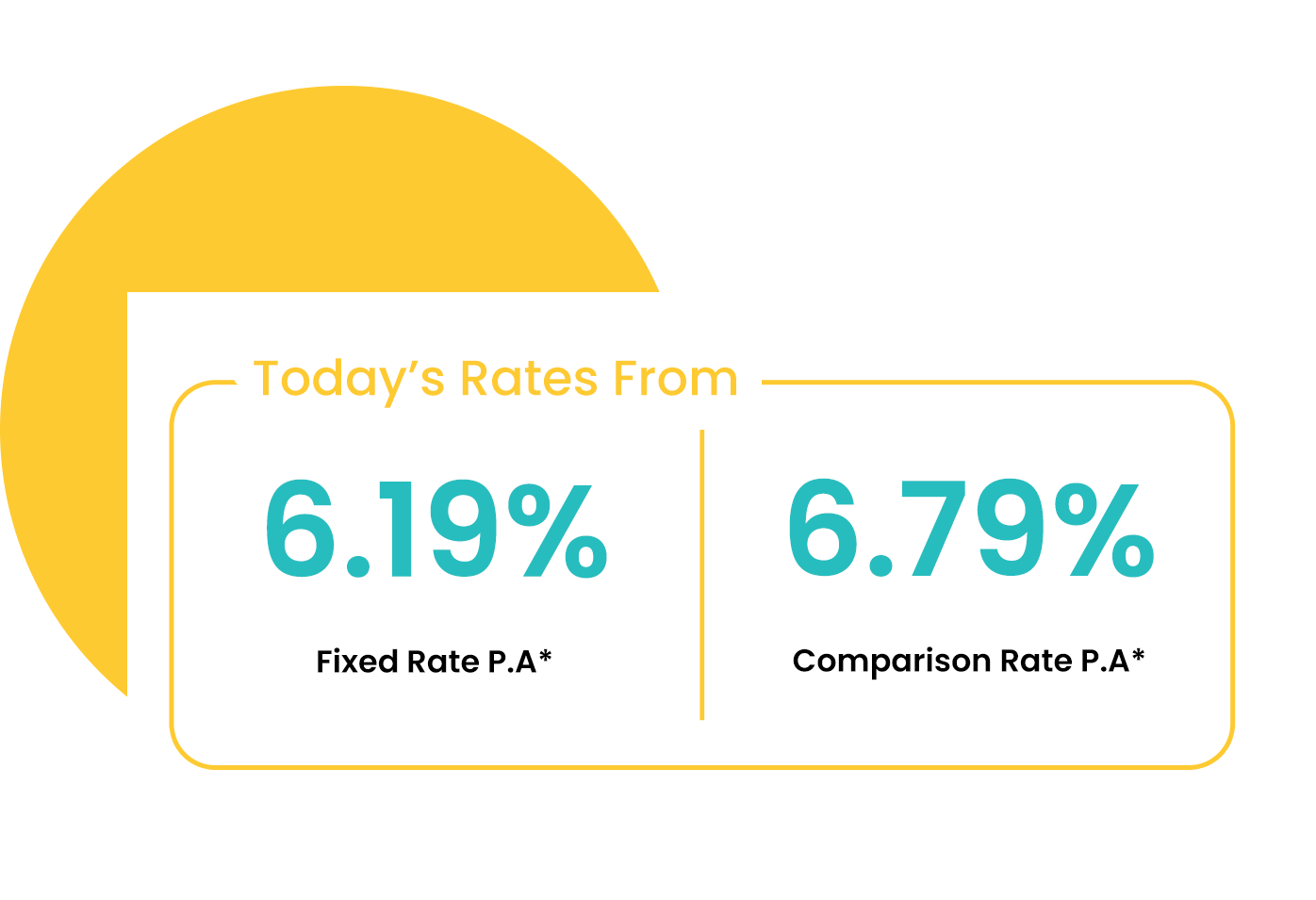

Please note: This is an estimate provided for illustrative purposes only, and is based on the accuracy of information provided. It does not constitute a quote. Additional fees and charges may apply dependent on your individual circumstances. Fees such as early repayment costs and establishment fees are not accounted for in the examples of weekly repayments. Interest rates may be subject to change throughout the term of the loan.

Benefits of Business Equipment Financing in Brisbane with Buddii

When you use a loan to invest in equipment, it frees up working capital which can then be used in more effective ways than having your cash tied up in equipment. A key component of success in business is cash flow, after all, so you should always choose wisely when it comes to how you spend your money. An business equipment loan makes sense if you need machinery or items for your business but don’t want to tie up your cash in a non-liquid asset.

- Flexible equipment loans from a range of trusted lenders

- Fixed or variable interest rates for commercial equipment financing

- Access to machinery finance, heavy equipment financing and construction equipment financing

- Quality business equipment financing advice from our experienced brokers

- Potential tax deductions for depreciation and costs of running

Who We can help

Do you run your own business and/or need smart financing for commercial equipment? We can help you. Whether you need plant equipment, heavy machinery or new computers and information systems, equipment lease financing or other equipment loans in Australia, we can source the right loan for your circumstances and financial situation.

At Buddii, we know how important it is to structure your business equipment financing to maximise cash flow and minimise the impact on your daily operations. We can work with you to uncover the needs of your business and structure your loan intelligently so that it has minimal impact on your everyday transactions while giving you fast access to the funds you need for your next project.

How to Choose Machinery Finance and Equipment Loans in Brisbane

No matter what you’re doing in business, you need to be smart about it – and getting an equipment loan is no different. We can help you to work through the wide range of loan products available and match you with the right solution for your project and business structure. Our loan specialists will work closely with you to help you identify the right loan for your business, with equipment financing rates that make the most sense. When choosing your business equipment financing, it helps to think about:

Purpose of equipment

How you’ll use your equipment can influence the type of loan you get, the tax benefits you’ll receive and potentially even the rates you pay. Clearly identifying the purpose of your new equipment can help you save more money in the long run.

Type of loan

You should also think about the type of loan you want to secure. Are you after a commercial hire purchase? Perhaps you want to refinance something? Equipment loans come in different types and structures, so it helps to determine what’s right for your business.

Payment structure

Determining the payment structure that works best for your business can help you make sure that your equipment loan works for you, not the other way around. No matter what you need equipment financing for, our loan brokers can help you determine your ideal options. Our specialists will consider all the factors in your situation and uncover the right finance solution to help you take your business where you want.

Work Through Your Financial Situation

To ensure successful finance and the best return on your investment, you must think about your business’s current financial situation and the impact your loan will have on your operations. Can you afford a high repayment schedule, or would a lower repayment amount suit you over a longer term?

Don’t risk having any of your questions unanswered and setting yourself up for a tough time down the line. At Buddii, we can help you find the perfect loan product for your commercial equipment financing needs. Remember: we work for you – not the banks or lenders – so you can rest assured we’ll always have your best interests in mind..

faqs

Yes indeed. In many cases (provided you’re not on a lease), you can exit your loan early. The exit fees are usually quite reasonable, but you would need to get clarification from your Buddii broker to find out exactly how much the fees are for each lender.

Whether you’re starting a new business or expanding it, the right business loan can take your business to the next level. At Buddii, we can help you find and secure a business loan to drive you closer to your goals – whatever they may be.

Yes, you can. We’ll even go a step further and check out the seller to make sure that any amount left owing on the asset is paid out at settlement.

We are financial brokers and specialists in linking you with the right loan product for your needs. We can provide you with a great rate on finance for cars, boats, trucks, equipment, machinery and a lot more. Get in touch to find out more about what we can finance.

our lenders

We work with a diverse range of top-tier lenders to make sure that you secure the competitive car loan interest rates and finance product for your personal needs and budget. We know that buying a car is a big deal, and you want to ensure that you have solid financial backing from the best Australian lenders. At Buddii, we partner with leading banks and financial institutions to offer the kind of wholesale rates that simply aren’t available anywhere else. This gives you more options for finding the ideal car finance deal.

Contact our Car Loan Specialists Today

Get started by giving us a call on 1300 BUDDII or enquire online by using our contact form. We are your partners in quality equipment finance, and we can help you make a difference in your company’s bottom line with the right equipment financing driving its growth.

Enquire Now With Buddii

For an obligation free chat with one of our expert brokers.

"*" indicates required fields

location

KEEP IN THE FINANCIAL LOOP

sign up to our e-news feed